What are “registered accounts”? 🍁

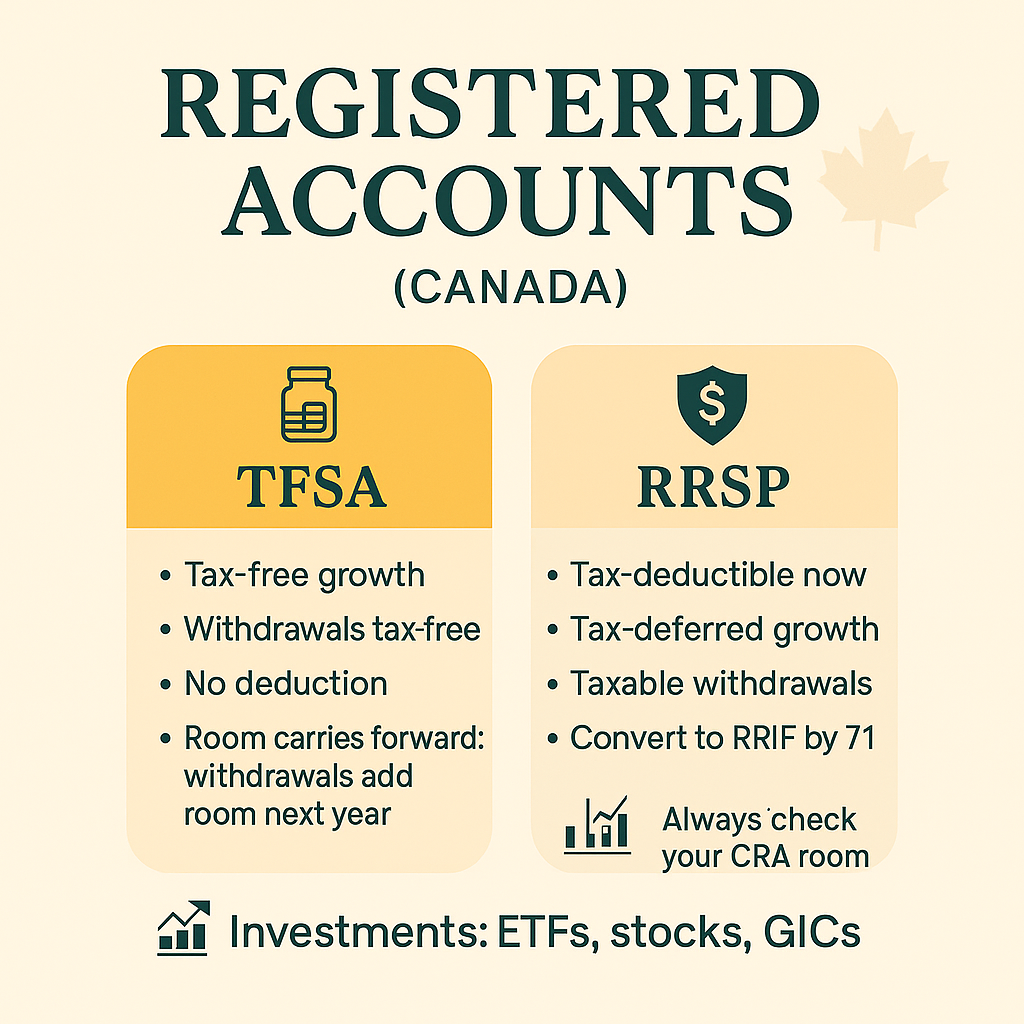

They’re savings/investment accounts the government registers with the CRA, which gives them special tax treatment (e.g., tax-free or tax-deferred growth). Two core ones for individuals are the TFSA and RRSP.

They’re savings/investment accounts the government registers with the CRA, which gives them special tax treatment (e.g., tax-free or tax-deferred growth). Two core ones for individuals are the TFSA and RRSP.

TFSA — Tax-Free Savings Account 💸

- Who can open: Canadian residents 18+ with a SIN.

- Tax treatment: Contributions are not tax-deductible, but all growth and withdrawals are tax-free.

- Contribution room: Increases every year you’re 18+ and a resident; unused room carries forward. Withdrawals create new room next calendar year. The 2025 annual limit is $7,000.

- Good for: Short-to-long-term investing (ETFs, stocks, GICs, etc.), emergency funds, goals before retirement—since withdrawals don’t trigger tax.

RRSP — Registered Retirement Savings Plan 💵

- Who can open: Most Canadians with earned income; room starts once you file a return.

- Tax treatment: Contributions are tax-deductible now; investments grow tax-deferred; withdrawals are taxable income later. Must convert to a RRIF/annuity by Dec 31 of the year you turn 71.

- Contribution room: The lesser of 18% of last year’s earned income or the annual dollar cap ($32,490 for 2025), adjusted for any pension adjustment; unused room carries forward.

- Special programs:

- Home Buyers’ Plan (HBP): Withdraw up to $60,000 for a first home; repay over time.

- Lifelong Learning Plan (LLP): Withdraw up to $10,000/year, $20,000 total for you or your spouse’s education; repay later.

- Good for: Reducing today’s taxes—especially useful if your income (and tax rate) is high now but expected to be lower in retirement.

TFSA vs. RRSP: quick rules of thumb👍🏼

- Lower tax bracket now / similar later? Prioritize TFSA.

- Higher tax bracket now / lower later? Prioritize RRSP (and try to reinvest the tax refund).

- Employer RRSP match? Capture the match first—it’s a guaranteed return.

- You can (and many do, including me) use both: e.g., RRSP for deductions, TFSA for flexibility, and it has tax-free access.

Lastly, please check your room 🔍

- TFSA & RRSP room are shown in CRA My Account (note: TFSA figures may lag current-year activity). RRSP room is also on your Notice of Assessment.

- Overcontributions result in penalties.