The Magic of Compound Interest 🪄

Compound interest might not be the most exciting topic, but understanding it is one of the most powerful tools you have for building wealth. Start investing early, be consistent, and let the power of compounding work its magic. Your future self will thank you!

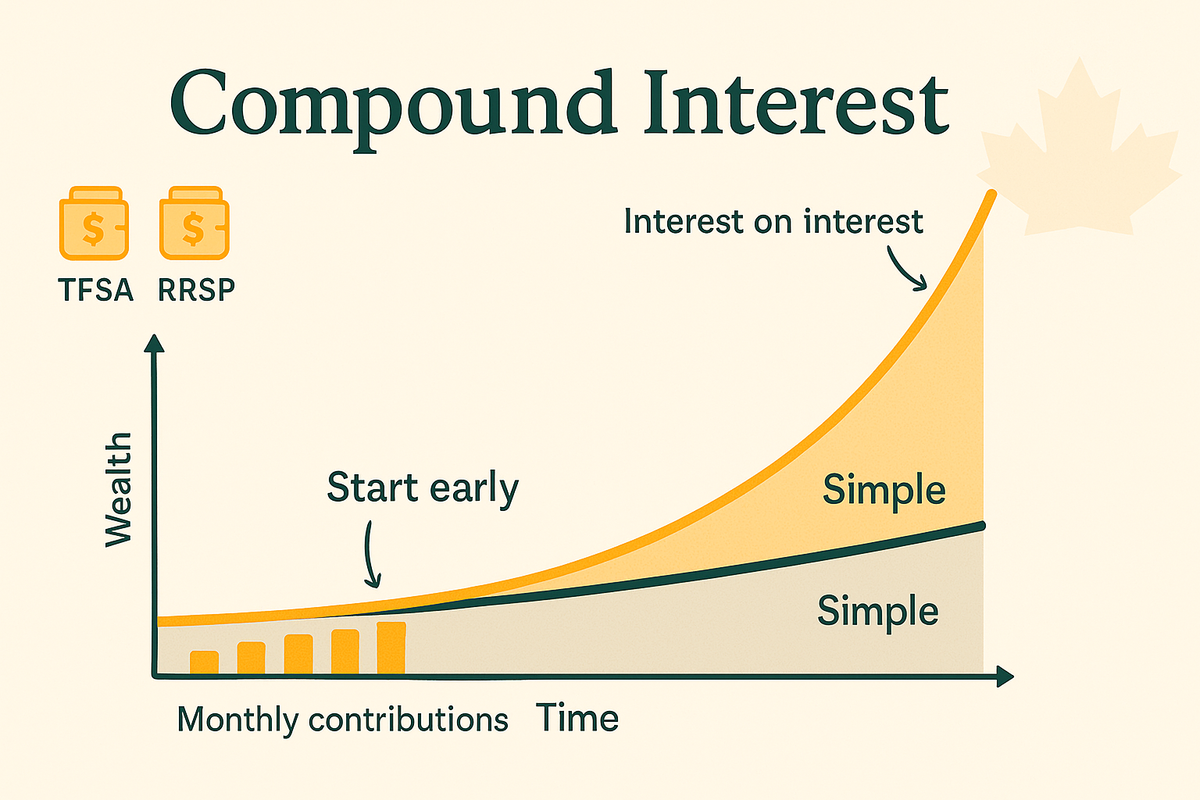

Hey everyone! Let's talk about something that might sound a bit dry, but trust me, it's the secret sauce to growing your money without a ton of extra effort: Compound Interest. Think of it as your money making money... and then that money making you more money. Pretty cool, right? It’s often called “interest on interest,” and it’s what allows your investments to snowball over time. This is great for everyone, but especially for young folks just starting their financial journeys.

What Exactly Is This "Compound Interest"? 🤔

In simple terms, compound interest means you earn returns not only on your original deposit (the principal) but also on the returns you’ve already accumulated.

Imagine you invest $100 and earn 5% interest in the first year. That means you now have $105. With simple interest, the next year you'd still earn 5% on that original $100, getting another $5, bringing your total to $110.

But with compound interest, things get interesting (pun intended!). In the second year, you earn 5% not just on your initial $100, but on the entire $105. So, you'd earn $5.25, bringing your total to $110.25. That extra 25 cents might not seem like much now, but this is where the magic starts to happen over time.

Another Way To See It: With a Two-Scenario Timeline

Let’s compare two savers, both aiming for retirement at 65:

| Age You Start | Monthly Contribution | Annual Return | Value at 65 |

|---|---|---|---|

| 25 | $250 | 6% | ~$464,000 |

| 35 | $250 | 6% | ~$237,000 |

Starting 10 years earlier nearly doubles your nest egg—even though the monthly contribution is the same!

Why Should Young People Care? 🌱

Because time is your greatest asset when it comes to compound interest. The earlier you start investing, the more time your money has to grow and compound. Think of it like planting a tree: the sooner you plant it, the more time it has to grow tall and strong.

- Small Amounts Can Make a Big Difference: You don't need to be rich to benefit from compound interest. Even small, consistent contributions can grow significantly over the years. Consider setting aside a small amount from each paycheck.

- Retirement Savings Become Less Stressful: Starting early means your money works harder for you, potentially reducing the amount you need to save later on for retirement. Imagine your future self thanking your younger self!

- Achieve Your Financial Goals Faster: Whether it's buying a house, travelling the world, or paying off student loans, compound interest can help you reach your financial goals sooner.

How to Harness the Power of Compounding 💪

- Start Investing Early: Seriously, the sooner the better. Even if it's a small amount, get started. Consider opening a registered account, either a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) or both. If you are in the States, a Roth IRA or a 401(k).

- Be Consistent: Regular contributions are key. Set up automatic transfers to your investment accounts so you don't even have to think about it. Choose a low-cost ETF or index fund. Look for broad American, Canadian or global equity ETFs with MERs under 0.20%.

- Reinvest Your Earnings: Make sure any interest, dividends, or capital gains you earn are reinvested. This is what fuels the compounding engine.

- Be Patient: Compound interest is a long-term game. Don't get discouraged by short-term market fluctuations. Stay the course, and let the magic happen.

The Wrap-up✨

Compound interest might not be the most exciting topic, but understanding it is one of the most powerful tools you have for building wealth. Young people, you have the incredible advantage of time. Start investing early, be consistent, and let the power of compounding work its magic. Your future self will thank you! 😉